[hide for=”!logged”]

V. Financial Equity

“Know what you own, and know why you own it.” ~ Peter Lynch

Financial equity is the value of your real and financial assets that can be priced, sold, and traded net of any debt you owe. It is sometimes called “net worth.”

Building financial equity is a process. Use your map to understand how the money around you works and start building real and financial assets one step at a time. Plan, budget, and conspire with the people around you to build and protect family wealth. Use your understanding of how to build living equity to help you build financial equity, and use that financial equity to protect your living equity—they are two sides of the same coin.

Again, you want to do business with the highest-quality people possible, whether attorneys, accountants, insurers, or others. You also want them to know you and establish a relationship with them before you need them. Stay on top of your financial accounts and invest in your archives because reality is what you can document in a marketplace and in a court of law.

Actions and Resources:

- Solari Members Post: New Jobs Bulletin Board

- Solution Series: Protecting Your Family’s Assets Through Wills and Trusts with Ann Christensen

- Solution Series: Protecting Your Home and Real Estate Assets with Marie McDonnell

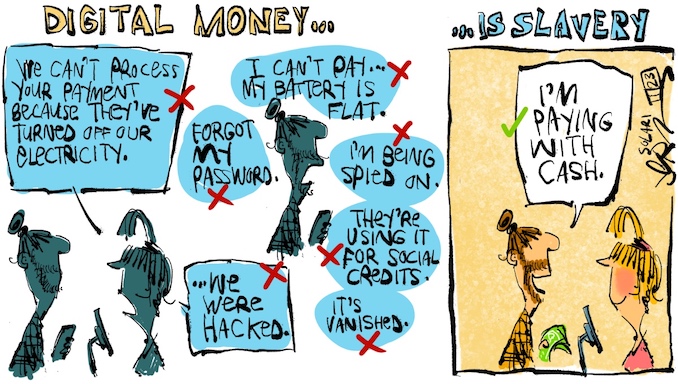

- Cash becomes more popular in Switzerland again

- Mish: The Perfect Solution To The Banking Crisis Is To Make A Truly Safe Bank

- Ten Questions to Ask Your Bank

Unanswered Questions:

Question #46: Economic and Legal Uncertainties Whither the U.S. dollar as reserve currency? Are we facing more significant inflation? Will interest rates continue to go up? How deep can the equity correction go? Are we entering a bear market? Are there any jurisdictions that will respect personal assets and property rights?

Question #47: Community Currency How do I start a community currency? Are there some simple first steps I can take?

Question #48: Bitcoin and Cryptos Will regulators and tax enforcement move in on all digital assets in 2023? Are the Australian crypto reforms coming throughout the G20? What will this do to the price and liquidity of my crypto holdings?

Question #49: Asset Stripping Will IRAs, 401(k)s, superannuation, and other retirement plans be respected? Will regulators force additional purchasing of U.S. Treasury notes, bills, and bonds? How far will mandates and social credit go? What will the next rounds of disaster capitalism look like and how do small businesses, farms, and banks prepare to overcome them?

[/hide]